2025 MIPS Targeted Review – Step By Step Guide to Maximize Incentives | TriumpHealth

2025 MIPS Targeted Review - Step By Step Guide to Maximize Incentives | TriumpHealth

1. Understand What Is a Targeted Review

A “Targeted Review” allows clinicians, groups, or APM entities to request CMS revisit their 2026 MIPS payment adjustment calculation based on 2024 performance data. This process is limited to score/calculation errors, such as wrong TIN/NPI submissions or incorrect reweighting – not general scoring methodology concerns.

2. Know the Valid and Invalid Review Reasons

Valid Issues Include:

- Data submitted under the wrong TIN or NPI

- Missed eligibility for category reweighting or

hardship exceptions - Denominator reductions not applied

- Misinformation on APM/QP or virtual group

status

Invalid Reasons Include:

- Disagreements with benchmarks or scoring methodology

- Requests for clarifications, not corrections

- General policy misunderstandings

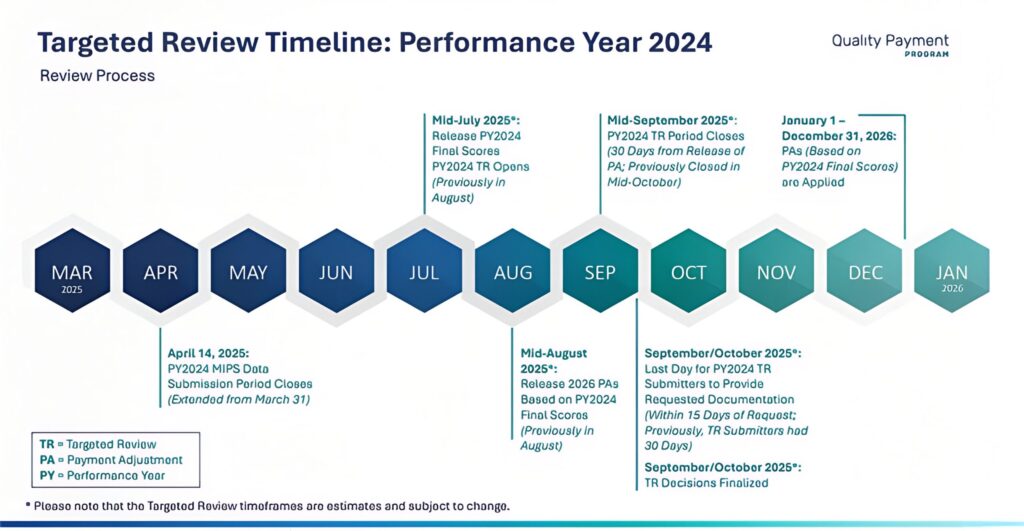

3. Timing & Deadlines

For the 2024 performance year / 2026 payment year, the Targeted Review window typically opens immediately after CMS releases final performance feedback, and lasts for at least 60 days. Based on previous cycles, it is projected to run from July to August 2026. Submit as early as possible!

Source: https://qpp.cms.gov/resources/resource-library

4. Prepare Before Submission

A. Identify the Submitter

Designate who will file the review (individual clinician, group lead, APM entity staff, or third party registry). Gather their NPI, TIN, or APM ID

B. Access or Create a HARP Account

Log in to qpp.cms.gov with HCQIS/HARP credentials. Intermediaries must have proper delegated access

C. Gather Documentation

Collect evidence to support each issue:

- EHR data extracts

- Registry submission files and confirmations

- Copies of submissions to CMS

- QPP Service Center case numbers

- Exception approvals (hardship, extreme, etc.)

5. Access the Targeted Review Application

- Sign in at qpp.cms.gov.

- From the left menu, select “Targeted Review”.

- Click “+ Add New Targeted Review”

6. Complete the Form

Step 1: Select Application Type

Choose the correct level:

- Individual (TIN/NPI)

- Group (TIN)

- Virtual Group (Virtual Group ID)

- APM Entity (APM ID)

Step 2: Enter Identifying Information

CMS pre-populates fields after entering NPI/TIN/APM ID. Review and correct if needed

Step 3: Provide Submitter Details

Add contact info and indicate relationship to the entity. Include additional staff emails if needed

Step 4: Choose Performance Categories

Tick all categories affected by the issue (e.g., Quality, Cost, Promoting Interoperability)

Step 5: Select Issue Type & Provide Explanation

Pick the appropriate error type and include a detailed narrative describing the mistake

Step 6: Attach Documentation

Upload all supporting files using the secure CMS portal. You may also submit later via the “Comments” feature

Step 7: Certify & Submit

Review the disclosure, certify accuracy, and submit. You’ll see confirmation within the portal and via email .

7. After Submission

Track Review Status

Under Targeted Review Progress Summary, you can view your submission’s status (e.g., Draft, Submitted, In Review, Approved, Denied)

Communicate via Comments

Use the portal’s Comments to respond to CMS requests – avoid contacting QPP directly. Upload new documentation as requested

8. Maintain Documentation

CMS requires retention of all documentation related to the review for 6 years post-performance year – keep them securely stored

9. Watch for Final Decision

- CMS typically completes reviews within the review window. Monitor email and portal for final Approved or Denied notices.

- If approved, CMS will adjust your 2025 Medicare payment multiplier, affecting 2026 reimbursements.

Why TriumpHealth for Targeted Reviews

TriumpHealth offers expert credentialing services backed by years of experience working with government, commercial, and private payers. For more information, contact us at (888) 747-3836 x0 or email [email protected].

Recent Posts

- MIPS 2026 Updates: A Practical Guide for Clinicians, Practices, and Office Managers

- CHAP Accreditation Updates for DME Suppliers: Step-by-Step Guide for Location Changes and Adding New DME Supplies

- Payer Contract Negotiations: Key Terms & Strategies | TriumpHealth

- Medicare Billing Guidelines for Q-Codes with CPT 15271–15278: A Guide for Wound Care Physicians

- Why Taxonomy Codes Matter in Provider Credentialing & Medical Billing

- How to Transition Provider Credentialing When Leaving or Joining an ACO