Financial Reporting & Analysis

- Prior-Authorization

- Charge Entry & Claims Management

- Clinical Chart & Coding Audits

- Payment Posting

- Accounts Receivables Management

- Self-Pay Collections

- Denial Prevention

- Denial & Appeals Management

- Patient Statements & Patient Calls

- Provider Credentialing & Enrollment

- Practice Start-Up

- Financial Reporting & Analysis

Financial Reporting & Analysis

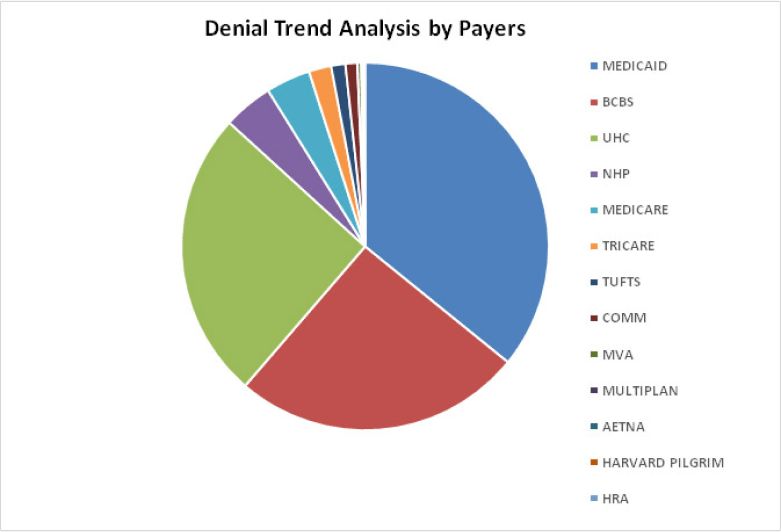

TriumpHealth does not provide clients with mounds of paper each month in which a few important pieces of information are hidden. Our financial reporting gives you the insight you need to address the root causes of charge issues, resolve process inefficiencies, improve coding compliance, and ensure the integrity of all claims. Office Managers and Administrators can easily review performance and trends, drill down into the data to analyze root cause by reason, evaluate payer performance, and the financial impact of claim denials.

Examples of some of the financial reports we provide (above and beyond the typical month end reports that give details around charges, collections and your AR) include:

- Charge Revenue Analysis – evaluate financial ratios versus MGMA benchmarks

- Coding Analysis – identify potential under, over and incorrect coding scenarios

- Procedure Analysis – analyze top CPT codes for cost benefit analysis

- Payer Reimbursement Analysis – assess which payers consistently slow up payments through unnecessary denials and “lost” claims

- Provider Staff Productivity Analysis – evaluate provider and staff productivity based on specific place of service, revenue and RVU’s

- AR Aging Analysis – velocity of payments per payer and CPT respectively

Frequently Asked Questions

What is the importance of financial reporting and analysis in healthcare, and how does it contribute to the overall financial management of medical practices?

Financial reporting and analysis in healthcare are crucial for medical practices as they provide insights into revenue, expenses, and overall financial performance. This data helps in strategic decision-making, budgeting, and resource allocation, contributing to effective financial management and sustainable growth.

What types of financial reports do you provide, and how frequently are they generated for healthcare providers to assess their financial performance?

We provide comprehensive financial reports tailored to healthcare providers, including charges, collections and adjustments, AR aging report, gross and net collection ratios, payer and procedure reimbursement reports etc. These reports are generated and reviewed monthly to ensure proactive management of financial performance.

Can you explain the key metrics and indicators included in your financial reports, and how they help healthcare providers make informed decisions about their practice?

Key metrics and indicators in our financial reports include payer reimbursement trends, accounts receivable aging, and collection ratios. These metrics help healthcare providers assess revenue cycle performance, identify areas of inefficiency, and make informed decisions to improve financial health and operational efficiency.

How do you ensure the accuracy and completeness of financial data during the reporting and analysis process, and what measures are in place to address discrepancies or errors?

We ensure accuracy and completeness through rigorous data validation processes, reconciliation of financial records, and regular audits. Automated checks and balances are in place to detect discrepancies or errors, and our team promptly investigates and rectifies any issues to maintain data integrity and reliability.

What strategies do you employ for financial analysis, and how do you assist healthcare providers in identifying trends, opportunities, and areas for improvement in their financial performance?

We employ advanced analytical tools and methodologies to conduct financial analysis, including trend analysis, variance analysis, and benchmarking against MGMA and HFMA standards. Our team collaborates with healthcare providers to interpret findings, identify trends, and pinpoint opportunities for revenue enhancement, cost reduction, and process optimization, empowering them to achieve their financial goals and improve overall performance.

Benefits of Working with TriumpHealth

Financial Reporting and Analysis

Customizable Reporting

We generate detailed reports that align with your unique practice needs.

Performance Metrics

Gain access to key metrics like gross and net collections, collections per visit, clean and denied claim rates, ensuring a steady cash flow.

User-Friendly Financial Dashboard

You can navigate through complex data with our intuitive financial dashboard.

Stronger Fiscal Management

We provide healthcare excellence powered by financial transparency and clarity.

Maximize Your Revenue. With Expert RCM Services

Schedule a consultation today to achieve financial success and regulatory compliance. Let us help you improve patient outcomes while increasing your revenue.