Converting Your Plastic Surgery OR into an Accredited ASC: A Complete Guide for Surgeons

Converting Your Plastic Surgery OR into an Accredited ASC: A Complete Guide for Surgeons

For plastic surgeons, an in-office operating room (OR) provides convenience, privacy, and control over the surgical experience. However, there’s a major limitation: reimbursement. Independent ORs are classified as physician offices, which means insurers reimburse only the professional fee. The practice absorbs all costs for anesthesia, nursing, equipment, and surgical supplies, making it financially restrictive over the long term.

By converting an office-based OR into a CMS-certified Ambulatory Surgery Center (ASC), plastic surgeons can capture both the professional fee and the ASC facility fee, expand surgical capabilities, reduce patient out-of-pocket costs, and build a profitable growth engine for the practice.

This guide provides a step-by-step overview of converting your OR into an ASC, including licensing, certification, accreditation, payer contracting, and the critical business entity setup (LLC, Tax ID, and NPI).

1. Why Convert an OR into an ASC?

Limitations of an Independent OR

- Only the professional component (surgeon’s fee) is reimbursed.

- No facility fee from Medicare or commercial payers.

- All overhead costs for anesthesia, OR staff, and equipment fall on the practice.

Advantages of ASC Ownership

- Ability to bill for both the professional and facility fee.

- Lower patient coinsurance compared to hospital outpatient departments.

- Greater control over scheduling, staff, workflow, and patient experience.

- Potential to expand by contracting with other surgeons to increase utilization.

- Improved negotiating position with payers as a licensed facility.

2. Step-by-Step Process: Converting Your OR into an ASC

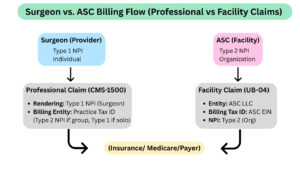

Step 1: Establish a Separate Legal Entity (LLC or Corporation)

To operate as an ASC, surgeons must form a separate business entity distinct from their medical practice.

- Create a new LLC (or corporation) for the ASC.

- Obtain a new Tax ID (EIN) for the ASC.

- Apply for a Type 2 NPI (organizational NPI) for the ASC facility.

Why this matters:

- The surgeon’s practice bills for professional services.

- The ASC bills for facility services.

- This structure provides liability protection, tax separation, and compliance with payer requirements.

Step 2: State Licensing

Apply for licensure through your state’s Department of Health. Requirements typically include:

- Life safety and fire safety compliance

- Infection control and sterile processing standards

- Minimum OR and recovery area square footage

- Proper sterile supply storage

- Qualified anesthesia providers and credentialed staff

Step 3: Medicare Enrollment & CMS Certification

- File CMS Form 855B to enroll the ASC with Medicare.

- Undergo a CMS survey or a deemed-status survey through an approved accrediting body.

- Comply with 42 CFR Part 416 ASC Conditions for Coverage, including:

- Patient rights and informed consent

- Quality assessment and performance improvement

- Infection prevention protocols

- Governing body and administrative oversight

Step 4: Accreditation

Accreditation is not always mandatory but is highly recommended and often required by Medicare and Commercial payers. Accreditation demonstrates commitment to quality and compliance. Options include:

- AAAHC (Accreditation Association for Ambulatory Health Care)

- AAAASF (American Association for Accreditation of Ambulatory Surgery Facilities)

- The Joint Commission

Step 5: Payer Credentialing & Contracting

Once licensed and CMS-certified, the ASC can contract with payers as a facility provider.

- Apply with Medicare, Medicaid, and commercial insurers.

- Negotiate contracts with attention to:

- ASC reimbursement rates (Medicare ASC Fee Schedule vs. commercial contracts)

- Bundling and implant reimbursement rules

- Case-mix optimization to ensure financial sustainability

Step 6: Operational Readiness

- Hire and credential OR nursing staff, recovery nurses, and anesthesia providers.

- Implement ASC-specific EMR and billing platforms.

- Establish compliance programs for HIPAA, OSHA, and CMS reporting.

- Participate in the CMS ASC Quality Reporting Program.

3. Financial Impact of ASC Conversion

The financial opportunity of ASC ownership is significant.

Example: Breast Reconstruction with Implant (CPT 19318)

- Independent OR: Surgeon only bills professional fee (~$1,350).

- ASC: Surgeon bills professional fee (~$1,350) + ASC bills facility fee (~$3,740).

- Total Reimbursement: $5,090 vs. $1,350.

This represents nearly 4x higher reimbursement, while also lowering coinsurance for patients compared to a hospital outpatient department.

4. Business, Tax & Compliance Considerations

- Separate LLC protects liability and allows partnerships.

- Tax ID (EIN) required for payer contracting and financial operations.

- Type 2 NPI ensures CMS and payers recognize the ASC as a facility entity.

- Maintain separate accounting, malpractice policies, and compliance documentation for the ASC.

5. Billing Workflow (Professional vs. Facility Claim)

6. Key Considerations for Plastic Surgeons

- Capital Investment: Upgrades, staffing, and accreditation preparation require significant upfront costs.

- Regulatory Compliance: Surveys are rigorous; policies must meet state and federal standards.

- Case Selection: ASCs are best suited for low-risk outpatient reconstructive and cosmetic procedures.

- Growth Potential: ASCs can be expanded to serve ENT, dermatology, or orthopedic surgeons for increased case volume.

7. How TriumpHealth Supports Plastic Surgeons

At TriumpHealth, we help plastic surgery practices successfully establish and optimize ASCs with services that include:

- Entity setup guidance (organization structure – LLC, PLLC, Tax ID)

- NPI setup support

- Accreditation preparation with AAAHC, AAAASF, or Joint Commission

- CMS enrollment (Form 855B submission) and commercial payer credentialing

- Payer Contract Negotiations to maximize reimbursement

- Revenue Cycle Management (RCM) for both professional and facility claims

- Compliance consulting for HIPAA, OSHA, and ASC Conditions for Coverage

Our goal is to help you achieve certification and long-term profitability while reducing compliance risk.

Conclusion

Converting your in-office OR into an accredited ASC is not just a compliance step, it’s a strategic business transformation. By creating a separate entity with its own Tax ID and Type 2 NPI, securing state licensure and accreditation, Medicare certification, and payer contracts, plastic surgeons can dramatically increase revenue while lowering patient costs and improving care delivery.

With TriumpHealth as your partner, you can navigate this process with confidence, from entity formation to payer contracting and ongoing billing success.

Ready to streamline your Plastic Surgery OR into an Accredited ASC? Schedule a Consultation today or contact us at [email protected] or (888) 747-3836 x0.

Disclaimer:

The content provided by TriumpHealth is for informational purposes only and does not constitute legal, medical, or financial advice. Regulations and payer requirements may change; please consult a qualified professional for guidance specific to your situation. Click here to review our full legal disclaimer.

Recent Posts

- MIPS 2026 Updates: A Practical Guide for Clinicians, Practices, and Office Managers

- CHAP Accreditation Updates for DME Suppliers: Step-by-Step Guide for Location Changes and Adding New DME Supplies

- Payer Contract Negotiations: Key Terms & Strategies | TriumpHealth

- Medicare Billing Guidelines for Q-Codes with CPT 15271–15278: A Guide for Wound Care Physicians

- Why Taxonomy Codes Matter in Provider Credentialing & Medical Billing

- How to Transition Provider Credentialing When Leaving or Joining an ACO